Modern learning in motion

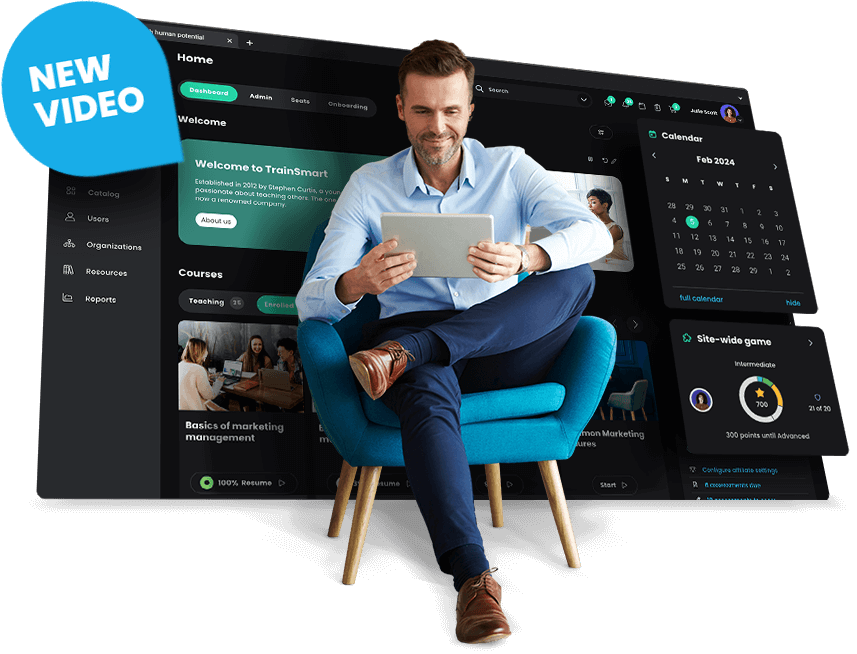

Need to engage learners? Want more time to train and connect with learners? Struggling to track performance and progress? The CYPHER platform takes the chore out of learning and training. Our beautiful, intuitive, and AI-powered platform engages learners, gives time back to teach and train, provides insights to drive better outcomes - all while keeping the human connection. Just the way modern learners expect.

Our human-centric approach is perfect for learning and development (L&D) professionals, HR leaders, trainers, instructional designers, learning platform admins, and managers. From skills-based learning to sophisticated automation and leveled-up gamification to the intuitive interface - every aspect has been thoughtfully built to modernize and energize the way we live and learn.

Supercharged training. In minutes.

Using AI 360 with CYPHER Copilot, supercharge your training experience. Build multimedia, gamified, skills-based training in minutes.

Why CYPHER?

A comprehensive, modern learning platform built to unleash human potential.

Learners can regularly up-skill, re-skill, and cross-skill with custom learning paths. We’re all about personalized learning that is tailored to the learner.

Automate course creation, gamification, assessments, etc. so you have more time to train and connect with learners.

Build a sense of community with games, leaderboards, chat, forums, activity indicators, Universal Translator, and mentorship.

Demonstrate learning ROI with skills competency and mastery. Make better decisions about your learning programs.

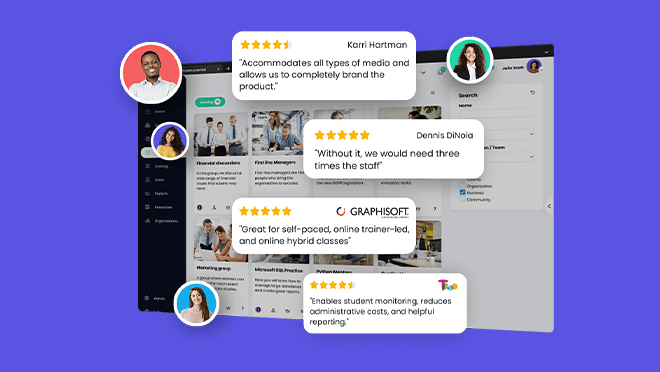

Trusted by companies around the world

1 platform. 3 powers. Limitless solutions.

From customer training to partner training to onboarding to mentorship to certification to compliance. We make it a reality.

- Extended enterprise

- Employee and growth

- Product and enablement

- Academia

For instructors

Instructors use CYPHER to design and provide high-quality courses for their learners. They automate processes to make training run as smoothly as possible for everyone involved.

For learners

Easily enable learners to fulfill their careers and upskill. Customize learning paths, track valuable skills needed for promotions, and advocate teamwork, all in one platform.

For managers

Whether you’re training employees or running a bank, your goal is to lead people. Keep all operations under control and scale your business one step at a time.

80% of surveyed organizations rate CYPHER training performance evaluation as better compared to the competition.

Survey of CYPHER customers

Award-winning platform for training

CYPHER has received multiple awards for our innovative learning technology, including Forbes Advisor’s “Best Overall Employee Training Software” and “Best LMS."

Fast implementation

We’ll help you get started!

Full support on every step of the implementation

Training by our experts

Quick migration of your existing content

Creating custom content